Copy Trading

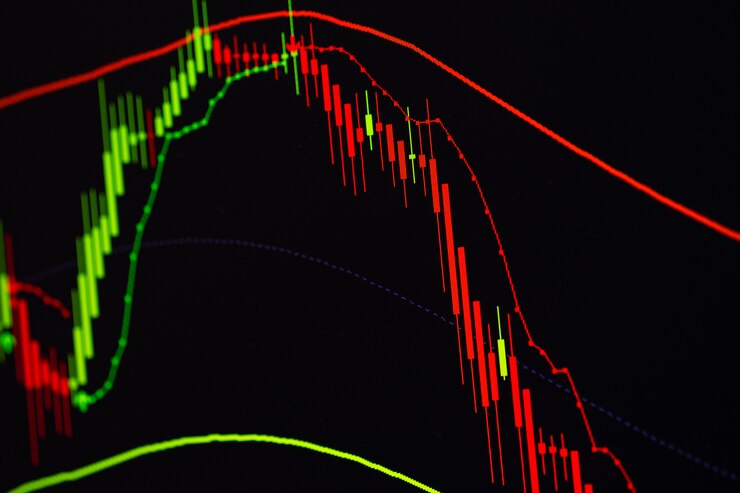

Copy trading has revolutionized the world of investing by offering a convenient and innovative way for traders to replicate the strategies of experienced investors. This social trading phenomenon has gained popularity due to its accessibility, transparency, and potential for generating consistent returns. In this blog, we delve into the concept of copy trading, its benefits, challenges, and tips for success.

Understanding Copy Trading: Copy trading, also known as mirror trading or social trading, allows investors to automatically replicate the trades of skilled traders or trading algorithms. Instead of making independent trading decisions, investors can follow the trades of selected traders or strategies, either manually or through automated platforms. This approach enables individuals to benefit from the expertise and insights of successful traders, even if they lack the time or expertise to trade independently.

Benefits of Copy Trading:

- Accessibility: Copy trading opens up investment opportunities to a wider audience, including novice traders who may not have the knowledge or experience to trade effectively.

- Diversification: By copying multiple traders or strategies, investors can diversify their portfolios and reduce risk exposure across different asset classes and trading styles.

- Learning Opportunity: Copy trading serves as an educational tool, allowing investors to observe and learn from the strategies, risk management techniques, and market insights of experienced traders.

- Time-Saving: Copy trading eliminates the need for extensive research, analysis, and monitoring of the markets, saving time and effort for busy investors.

- Transparency: Most copy trading platforms provide transparency in performance metrics, trade history, and risk profiles of traders, enabling informed decision-making for investors.

Challenges and Considerations:

- Risk Management: While copy trading offers potential rewards, it also carries risks. Investors should carefully evaluate the risk profiles of traders or strategies they intend to copy and consider implementing risk management measures such as diversification and position sizing.

- Performance Variability: Past performance of traders or strategies may not guarantee future results. Investors should assess performance metrics, drawdowns, and consistency before copying trades.

- Platform Selection: Choosing a reputable and reliable copy trading platform is crucial. Consider factors such as platform security, transaction fees, ease of use, and available markets.

- Monitoring and Review: Regularly monitor copied trades, review performance metrics, and adjust strategies or stop copying traders if necessary. Stay informed about market trends and news that may impact trading decisions.

Tips for Successful Copy Trading:

- Research and Due Diligence: Conduct thorough research on traders or strategies before copying. Evaluate performance metrics, trading style, risk management, and track record.

- Diversify: Copy multiple traders or strategies to diversify risk and optimize potential returns. Balance exposure across different asset classes, markets, and trading approaches.

- Set Realistic Expectations: Have realistic expectations about potential returns, risks, and volatility associated with copy trading. Avoid chasing high-risk strategies or unrealistic profit targets.

- Continuous Learning: Keep learning about trading principles, market dynamics, and risk management strategies to enhance your understanding and decision-making skills.

- Regular Review: Regularly review and assess copied trades, performance metrics, and overall portfolio health. Make adjustments as needed to align with your investment goals and risk tolerance.

Conclusion: Copy trading offers a compelling opportunity for investors to benefit from the expertise of seasoned traders and diversify their investment portfolios. By understanding the benefits, challenges, and best practices of copy trading, investors can make informed decisions, manage risks effectively, and enhance their chances of long-term investment success. Embrace copy trading as a valuable tool in your investment journey, empowering you to achieve financial goals and build a robust investment strategy.